- DIRECTORY

- Home

- The Direct Deduction Policy

- A Culture of Deception

- The Mandarins

- Discretionary Powers

- A Shocking Admission

- The Nation Betrayed

- Rewarding Service

- The Infamous Roe Case

- Portability: Retiring Overseas

- Kiwis in the US/Americans Down Under

- Kiwis Retiring in Australia Beware!

- CPP: Canadian Pensions Pirated

- A New Victim

- Dual Entitlement: British Pensions

- Dutch Pensions

- Kiwisaver

- Human Rights Commission

- Special Banking Option

- MSD: Deceiving Parliament and the Public

- New Crackdown on the Elderly

- Pension Equality

- About This Site

A Shocking Admission

Concealed 2005 Report on

NZ Superannuation Portability

In the concealed 2005 Report, part of the 7 year Review of NZ Superannuation Portability, one of the Ministry's proposed options calls on the government to deduct first-tier (universal, flat-rate) pensions only: "This option is designed to ensure that only overseas pensions that are similar to NZ Superannuation are deducted."

The 2005 Report admits that NZ Super is being withheld on account of pensions which are not similar to NZ Super: "Currently Section 70 authorizes the direct deduction of second-tier earnings-related pensions, despite the fact that, other than being administered by the state, they have little resemblance to NZ Super."

It would have been correct to say that the chief executive authorizes the direct deduction of second-tier earnings-related pensions. The report's explicit admission ("second-tier earnings-related pensions... other than being administered by the state... have little resemblance to NZ Super") means that Section 70 authorizes no such deduction.

The admission that second-tier earnings-related pensions have little resemblance to NZ Super affects the legality of withholding NZ Super only if it represents the opinion of the chief executive.

The chief executive has the power to withhold NZ Super by reason of the similarity - in his opinion - between other pensions and NZ Super (refer: Discretionary Powers). If the opinion of the chief executive, by his own admission, is that certain pensions are not similar to NZ Super, those pensions are not legally deductable.

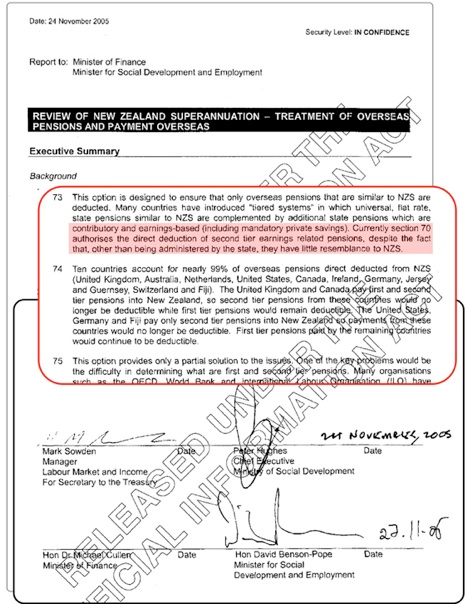

The report, including the admission, was personally approved, authorized and signed by the chief executive of the Ministry of Social Development and dated November 24th 2005:

The Integrity of the Government in Question

The revelation raises serious questions about the integrity of the person whose annual salary (exceeding half a million dollars not including bonuses) makes him the nation's second highest-paid civil servant. It also raises serious questions about the integrity of current and recent cabinet ministers.

The 2005 Report was released to the Minister of Finance and the Minister for Social Development. The signature of Hon David Benson-Pope (November 27th, 2005) confirms that senior cabinet ministers received from the MSD's chief executive information that deducting second-tier pensions is not justifiable.

Ministers of the Crown continued to defend the capture of overseas pension, falsifying the government's social security program and going to extreme lengths to conceal the telling content of critical reports. Successive Social Development ministers attempted to suppress reports prepared in the course of the government's Review of the Treatment of Overseas Pensions - until the Ombudsman ordered their release.

The contents of these reports reveal why ministers tried to obstruct their release: they implicate Ministers of the Crown and the Ministry in perpetrating fraud. There can be no doubt that the chief executive and senior cabinet ministers have disregarded the law.

The 2005 Report indicates that 43,300 elderly New Zealanders have $70 million of their NZ Super withheld every year on account of second-tier - contributory, earnings-based - pensions (the actual figure is believed to be considerably higher than that quoted in the report). Details of the 2005 Report exposing this activity, not sanctioned under the law, have been sent to every political party.

Not one of the nation's elected representatives has acknowledged the illegal treatment of overseas pensions, nor raised the matter in the House. No political party has insisted that the law is observed - it would deprive the government revenue of at least $70 million a year.

The reports in the Review of NZ Superannuation Portability warned the government that it was at serious risk of being challenged under the Bill of Rights Act due to the discriminatory nature of NZ Super. The failure to address the deduction of overseas pensions where it is not sanctioned under the law increases the risk of challenges, putting the government in an even more precarious position. When the state pension scheme is vulnerable to potential lawsuits, it has serious implications for all New Zealanders.

To view the 2005 Report in its entirety, refer: Review of New Zealand Superannuation Portability 2005

A 2005 government report admits that most overseas pensions subject to direct deduction have little resemblance to NZ Super.

The admission was approved, authorized and signed by the MSD chief executive.

If, ‘in the opinion' of the chief executive, an overseas pension is NOT similar to NZ Super, then deducting that pension is unlawful.

Senior cabinet ministers were informed that deducting most overseas pensions is not justified.

Ministers of the Crown continued to permit the deduction of overseas pensions and attempted to conceal the 2005 report.

In doing so, Ministers of the Crown have disregarded the law, implicating themselves in perpetrating fraud.

2005 report details were sent to every political party after their release by the Ombudsmen. Nobody raised the matter in the House.

© 2013 NZPENSIONABUSE.ORG